BECOMING A DONOR

Quick Access Menu

Interested in becoming a donor?

There are a number of different ways to give and each has the ability to send a ripple through your community. We encourage you to reach out to us with any questions you may have about becoming a donor.

Call us at (530) 622-5621 or fill out our contact form below.

You may also email info@eldoradocf.org to reach out directly to our Donor Services Coordinator.

We interact with our donors in several different ways throughout the year. Sending gift acknowledgements, holiday wishes, and event invites are just some of the ways we like to engage our donors. Having up-to-date contact information for our donors is crucial to maintaining that level of engagement. If any of your contact information changes, please let us know!

Call us at (530) 622-5621 or fill out the form below with your updated contact information.

Frequently Asked Questions

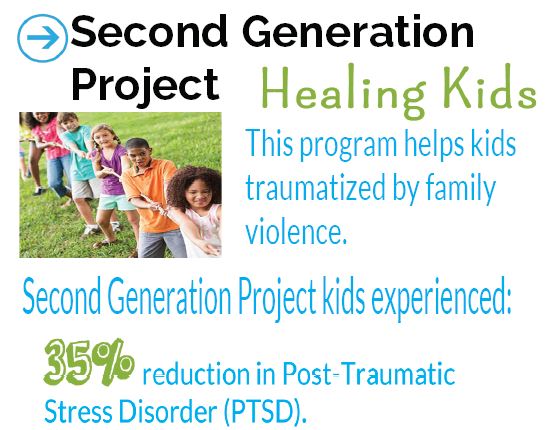

Living a life with purpose means choosing to make some of your hard-earned funds available to one of the many nonprofits available. You can support the arts, enrich education, protect the environment, provide human services, safeguard health, foster a stronger community, protect animals, support veterans, support first responders and more. Tell us what is important to you.

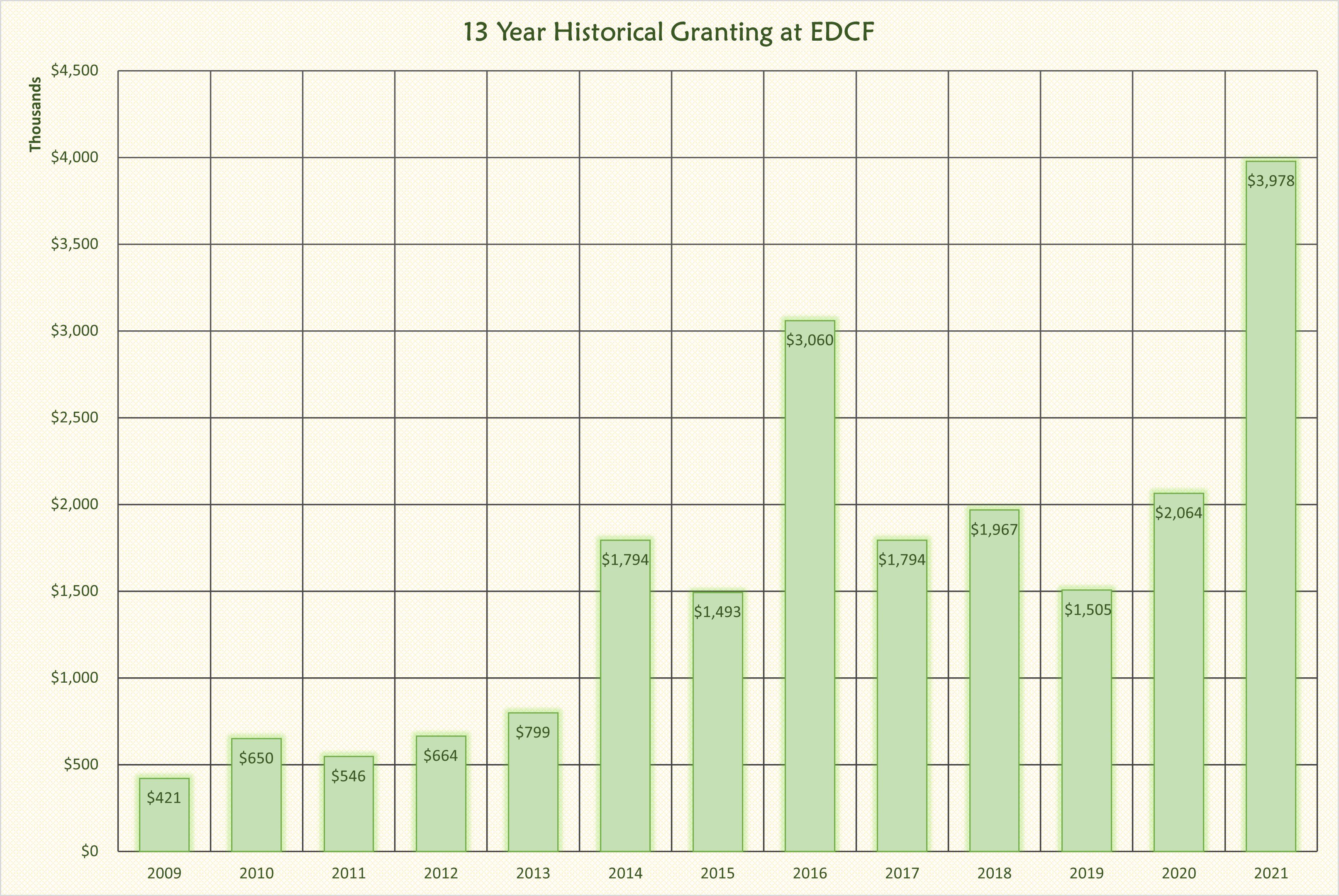

Easy, personalized, timely grant making is our goal. Grants may be made at any time, as long as sufficient assets are available for grant making under the terms of the fund agreement. Distributions may be made to any tax exempt charitable organization in good standing with the IRS. The Foundation keeps track of that for you. Grants to benefit individuals or private foundations are prohibited. There are no geographic or purpose related limitations or restrictions, unless otherwise imposed by your fund agreement or the US law. Distribution may not be used to satisfy any personal or corporate pledge or obligation of a founder, donor, or advisor, or to provide personal benefit to a founder, donor or advisor unless the benefit is permitted by the then applicable IRS and related regulations. Our professional staff is available to you assist you in the grant making process.

You can view the Foundation’s Nonprofit Directory for information on local nonprofits for charitable ideas.

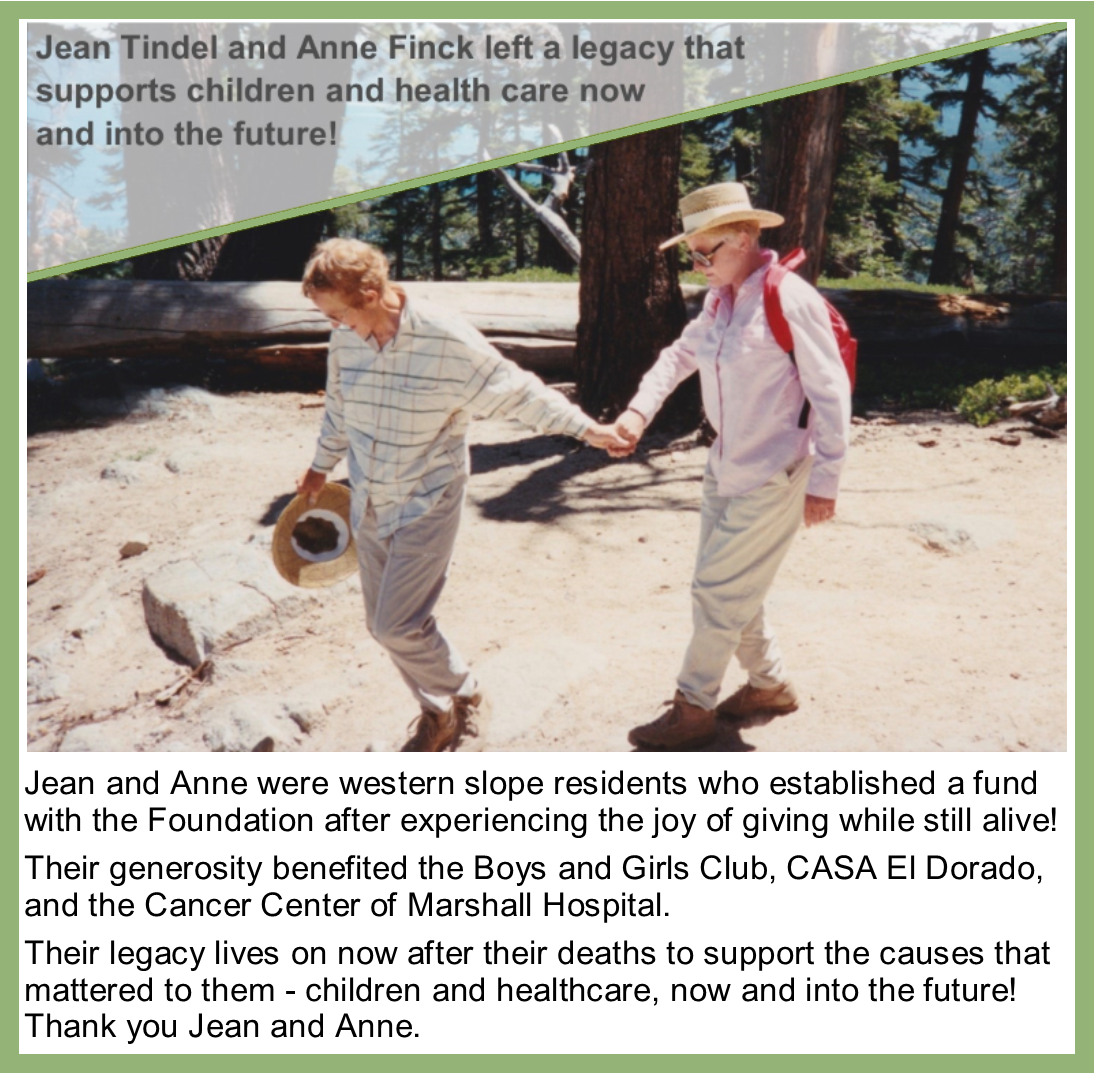

The Foundation can accept cash, appreciated securities, mutual fund shares, closely held stock, real estate, royalties and intellectual property rights, or life insurance. You can give a legacy gift by naming your fund as beneficiary of your will, revocable living trust, and some retirement plan assets. Consult with our professional staff or call your estate advisor to determine how to establish a fund that will live in perpetuity.

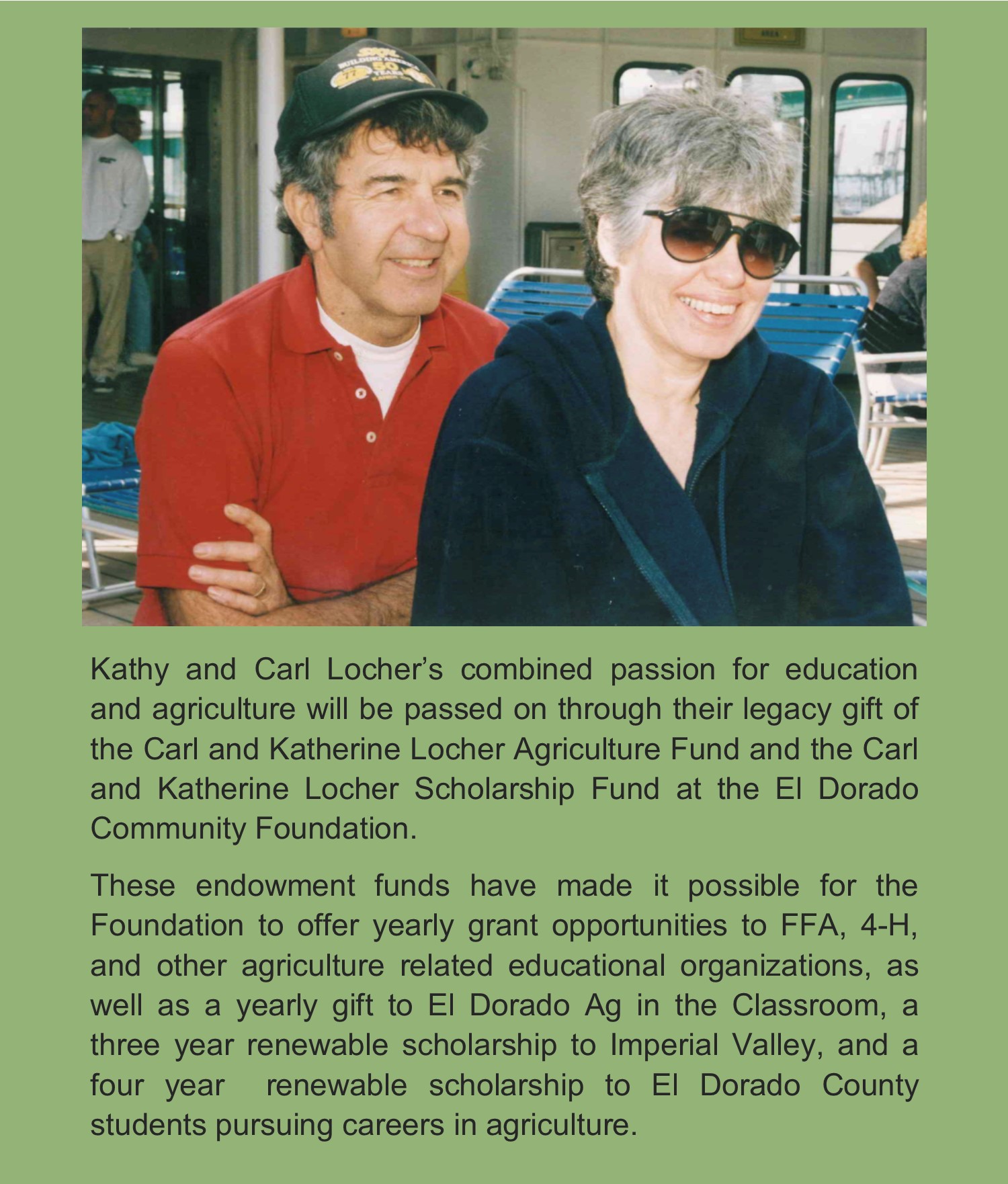

Check out Kathy and Carl Locher's story to learn more about how donations can continue having an impact long into the future.

Simplify your giving, and receive the tax deductible benefit immediately. Make as many additions to the fund as you wish. Accomplish both your financial and charitable objectives. For many people, these include preserving the family name, honoring loved ones, minimizing tax burdens, and supporting the community you call home. Bequests to the Community Foundation are exempt from estate taxes. Granting (paying out of the fund to your chosen charity) is done throughout the life of the fund. You or your advisors direct the payouts.

As your fiscal agent, the Foundation provides personal consulting services to you to help you accomplish your philanthropic goals.

The Foundation Finance Committee and Board of Directors is responsible for the investment of the pool of funds. Short Term funds which are expendable funds and operating funds are invested in cash and cash equivalents to assure adequate liquidity and safety for current use. Long Term funds, which include endowment funds,are invested to maximize total return consistent with safety of principal. Our staff will review our current investments with you in your initial meeting and at any time you have questions. You will receive annual and semi annual statements showing in detail the activity on your funds.

Donor Advised Funds are established by donors who wish to actively participate in the grant-making process. Individuals who establish a donor advised fund recommend charitable projects or organizations that they want to support. It is easy to give to multiple nonprofits through a donor advised fund. Our Board of Directors is legally responsible for approving all grants.

Family Funds are formed when several families have established their own advised funds. Family members get together to determine how the proceeds from their fund can best benefit the local community and beyond.

Agency Endowment Funds happen when donors wish to support a specific agency or cause. This can provide a relatively constant source of annual income and help maintain their mission in perpetuity. It frees the nonprofit to focus on what they do best in the community. A Board of Directors acts as advisors for grant making and fund raising. Agency funds can accept donations from any donor to support their cause.

See a list of our current Agency Endowment Funds accepting donations.

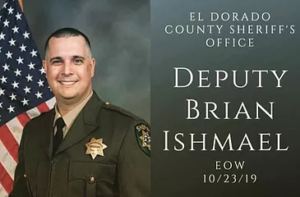

Committee Funds, also known as Collective Giving Funds, typically have many donors. These donors might assist in building the donor base for their fund and often will participate in the decision-making of the fund’s granting efforts through sub-committees. Also, unlike Field of Interest Funds, Committee Funds often change the focus of their granting efforts from year to year. As a contributing member of a committee fund, you will be invited to any events held by the committee funds.

See a list of our current Committee Funds accepting donations.

Field of Interest Funds are often established to support particular interest areas, specific program initiatives, causes or geographic areas. At the donor’s request, use of the funds is restricted to a specified area of interest, but flexibility remains to meet changing situations. Donors can create a new agency fund or contribute to and existing one.

See a list of our current Field of Interest Funds accepting donations.

Scholarship Funds are attractive to many donors and can be structured to benefit students at any education level, or for a specific institution. A scholarship fund can also be established to honor a loved one. Some donors choose to stay involved through advisory relationships, while others name advisory committees to assist in the selection of recipients. Either way, our staff will handle the necessary paperwork and will ensure that scholarships are distributed in an equitable manner.

Endow El Dorado Fund gifts are not specifically designated for use by a particular agency, cause, or area of interest. Our Board of Directors oversees the use of these funds, setting priorities based upon need.

For a complete listing of funds available for donation, click here.

The costs associated with providing these services are covered by an administrative fee assessed to each Fund. The Foundation provides: gift acknowledgement, investment oversight, fund accounting, tax compliance, biannual statements, grant recommendation processing, prospective grant recipient review, grant disbursement and tracking and grant evaluation and reporting.

Our staff can help you match your unique interests with the current needs in our community. You may need assistance from other professionals such as financial advisors, and/or your estate attorney.

- Decide what you can invest initially

- Review the committee funds that are available to see if joining with one of the existing funds would meet your objective.

- If having your own fund for you or your family is your goal, call us and we will guide you in deciding the purpose of your fund, who the Advisors of your fund will be, and help you determine the type of fund that would best meet your goals.

You can also fill out the form below and our Donor Services Coordinator will reach out to you.